Pionex Strategy Executor via Webhooks

Role: Lead Developer | Duration: September 2023

The Pionex Strategy Executor is an automated trading system that leverages webhooks to execute trading strategies on the Pionex cryptocurrency exchange. This solution provides seamless execution with real-time portfolio tracking and zero-fee transactions, including strategic profit analysis for informed investment decisions.

Experimental Project Disclaimer: This project was developed purely for experimental and educational purposes. The strategies and implementations demonstrated here are not financial advice. Cryptocurrency trading involves significant risks, and all trading decisions should be made based on your own research and risk tolerance. The project showcases technical implementation capabilities only.

Development Timeline

Research & Planning

Early September 2023

- API documentation analysis

- Strategy formulation

- Risk management planning

- System architecture design

Core Development

Mid September 2023

- Webhook endpoint setup

- API integration implementation

- Error handling system

- Testing framework creation

Strategy Implementation

Late September 2023

- Trading logic development

- Position management system

- Risk controls implementation

- Performance monitoring setup

Testing & Optimization

End of September 2023

- Live testing with small positions

- Strategy refinement

- Performance optimization

- Documentation completion

System Architecture

System Overview

Trading Signal Flow

Risk Management Process

Implementation Details

Webhook Handler

@app.post("/webhook")

async def webhook_handler(request: Request):

data = await request.json()

# Validate incoming signal

if not validate_signal(data):

logger.error("Invalid signal format")

return {"status": "error", "message": "Invalid signal format"}

# Process trading signal

try:

strategy = StrategyExecutor(data)

result = await strategy.execute()

return {"status": "success", "data": result}

except Exception as e:

logger.error(f"Strategy execution failed: {str(e)}")

return {"status": "error", "message": str(e)}

Risk Management Implementation

class RiskManager:

def __init__(self, config):

self.max_position_size = config.MAX_POSITION_SIZE

self.max_exposure = config.MAX_EXPOSURE

self.stop_loss_pct = config.STOP_LOSS_PCT

async def validate_trade(self, trade_params):

# Check account balance

balance = await self.get_account_balance()

if trade_params.size > self.max_position_size * balance:

raise RiskLimitExceeded("Position size exceeds maximum allowed")

# Check total exposure

current_exposure = await self.get_total_exposure()

if current_exposure + trade_params.size > self.max_exposure:

raise RiskLimitExceeded("Total exposure limit exceeded")

return True

Deployment Architecture

Server Setup

- Vultr Cloud Compute Instance

- Ubuntu 20.04 LTS

- 2 vCPU, 2GB RAM

- Automated backups

Security Measures

- SSL/TLS encryption

- UFW firewall configuration

- API key authentication

- Rate limiting

Process Management

- PM2 process manager

- Automatic restarts

- Load balancing

- Performance monitoring

Deployment Configuration

# Nginx Configuration

server {

listen 443 ssl;

server_name trading.example.com;

ssl_certificate /etc/letsencrypt/live/trading.example.com/fullchain.pem;

ssl_certificate_key /etc/letsencrypt/live/trading.example.com/privkey.pem;

location / {

proxy_pass http://localhost:8000;

proxy_set_header Host $host;

proxy_set_header X-Real-IP $remote_addr;

}

}

# PM2 Ecosystem Config

{

"apps": [{

"name": "trading-bot",

"script": "main.py",

"interpreter": "python3",

"instances": 2,

"exec_mode": "cluster",

"watch": true,

"max_memory_restart": "300M"

}]

}

Key Features

Real-time Execution

- Instant webhook processing

- Low-latency order execution

- Real-time status updates

Portfolio Tracking

- Live position monitoring

- Performance analytics

- Risk management

Risk Management

- Position size limits

- Stop-loss automation

- Exposure controls

Strategy Flexibility

- Custom strategy support

- Multiple timeframe analysis

- Parameter optimization

Performance Metrics

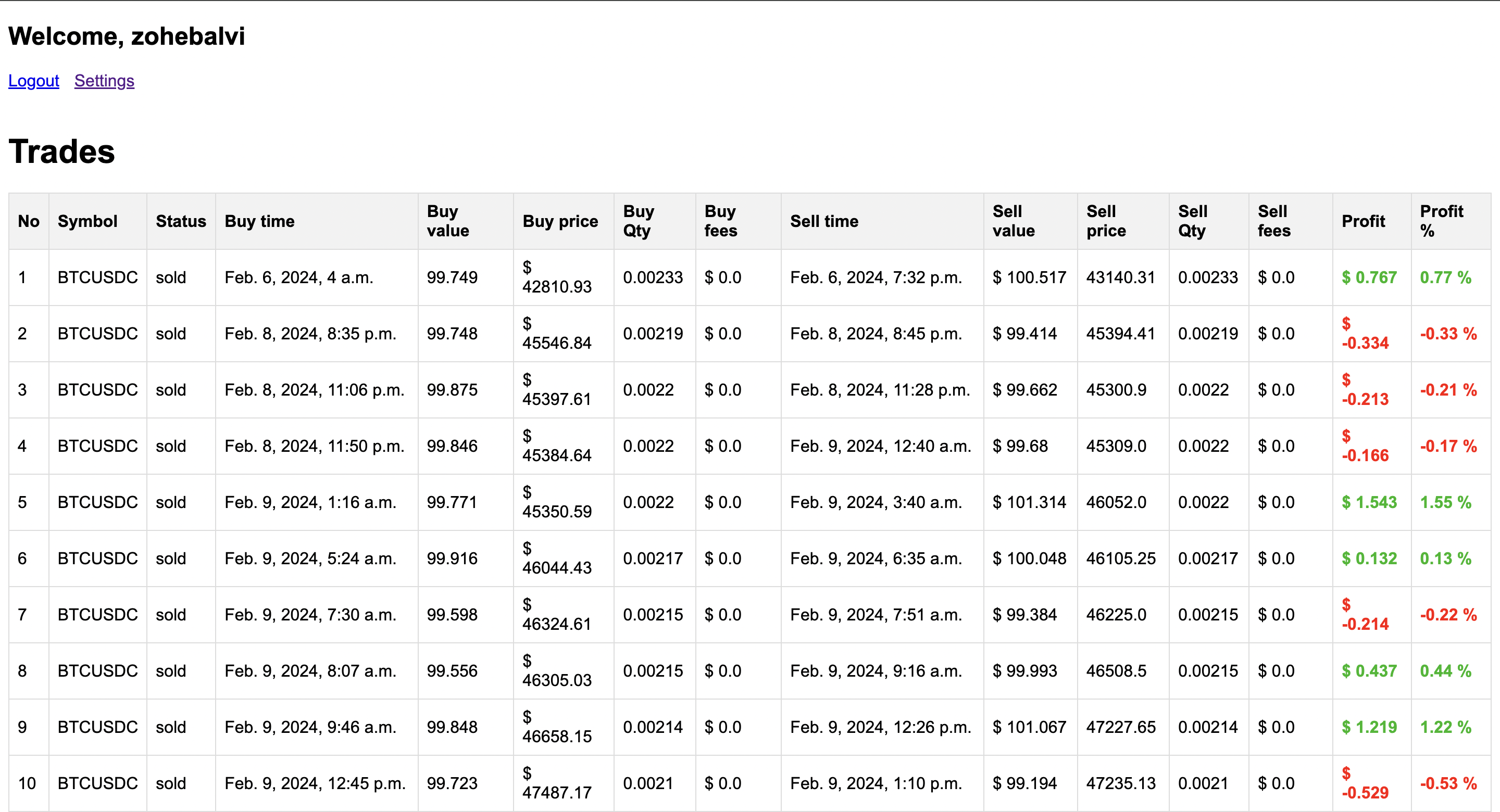

Live Trade Report Dashboard

Execution Speed

Average order execution time

Success Rate

Order execution accuracy

Win Rate

Strategy success rate

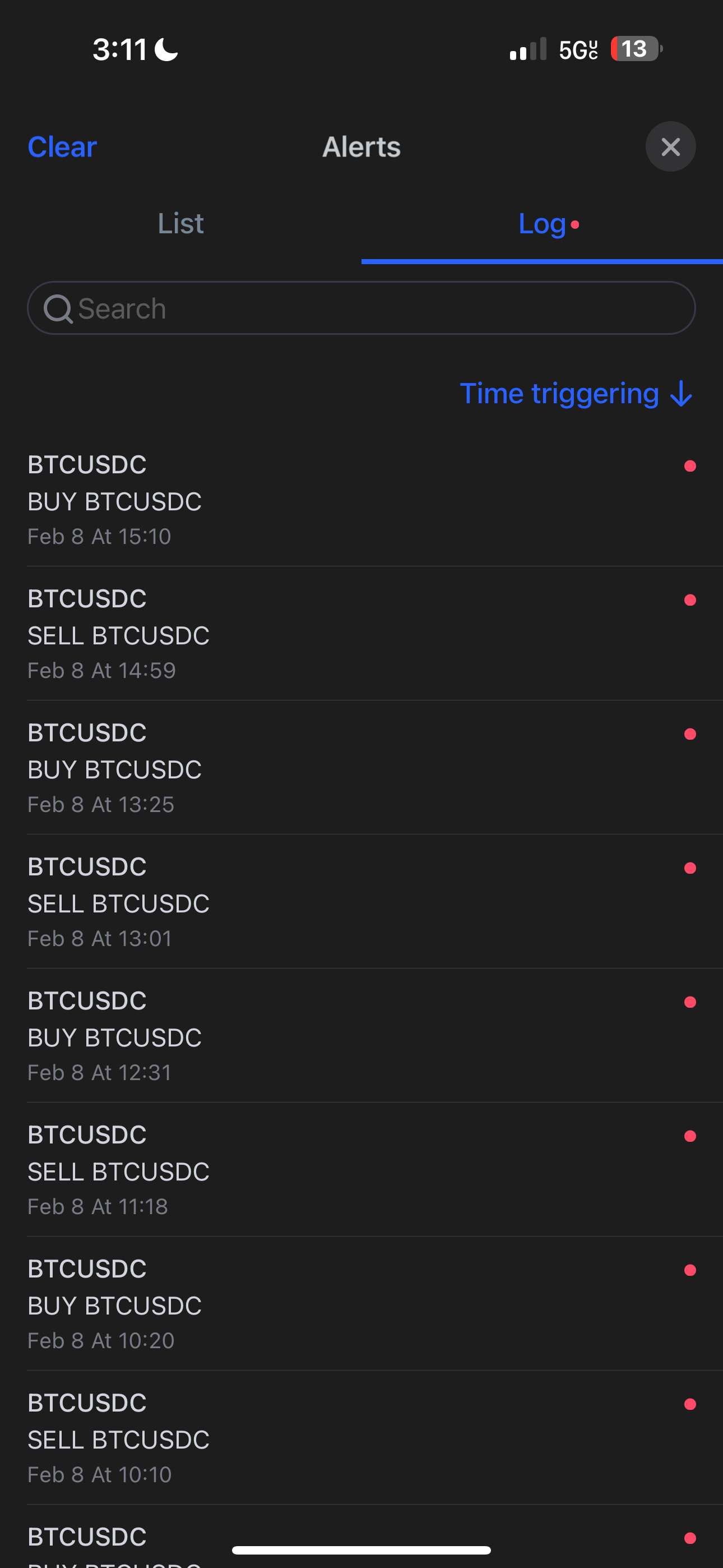

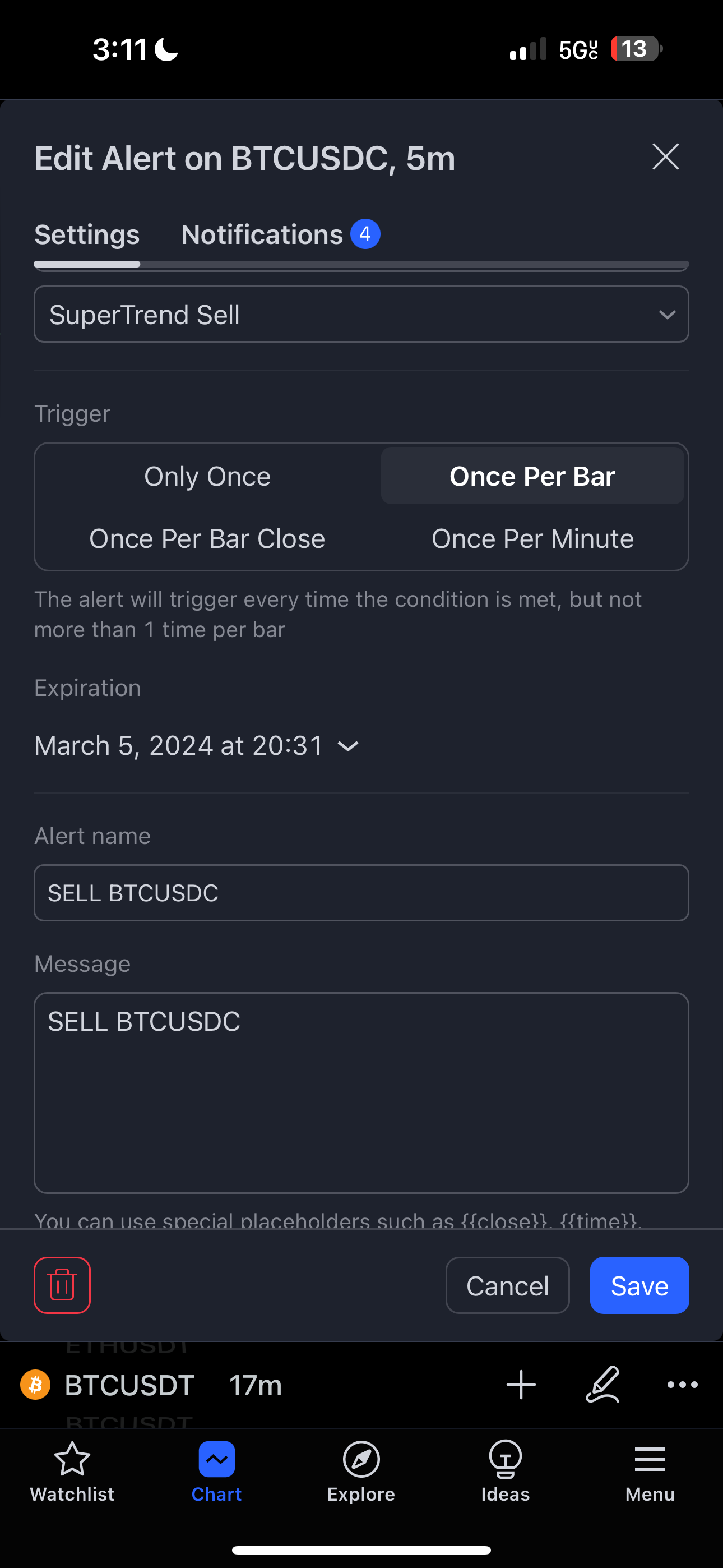

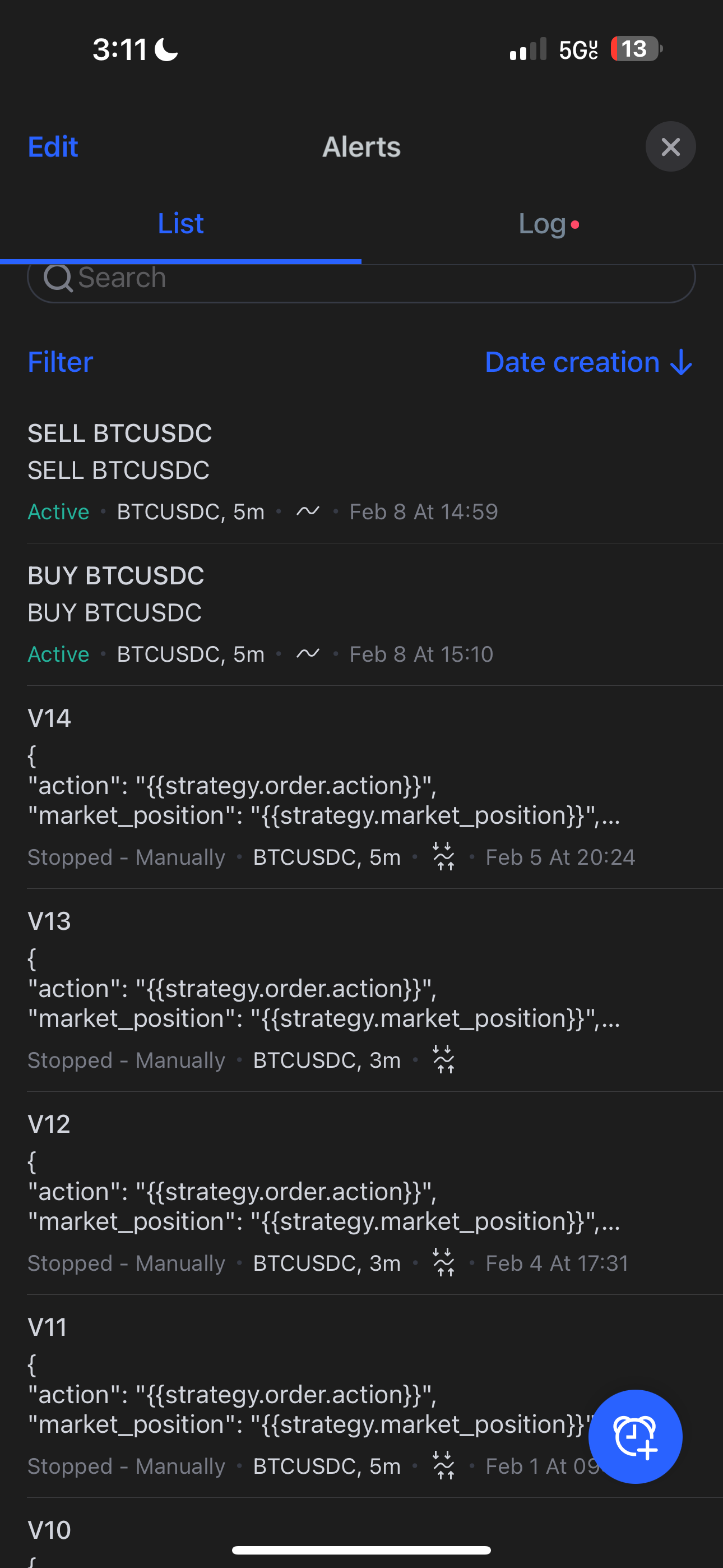

TradingView Integration

Alert Configuration

TradingView alert setup with webhook integration and custom message format.

Strategy Implementation

Custom strategy implementation with technical indicators and signal generation.

Performance Dashboard

Real-time monitoring of strategy performance and trade execution.

Project Resources

Access the project files and documentation for the Pionex Strategy Executor system.

Strategy Executor Package

Complete implementation including webhook handler, strategy executor, and documentation.